Insuring Teenage Drivers in Nevada

Estimated Reading Time: 10minutes

https://www.dmv.ca.gov/portal/dmv/detail/teenweb/more_btn6/traffic/traffic

This article will answer the following questions:

- How do I add a teenage driver onto my automobile insurance policy?

- What kind of coverage should I get for my teenager?

- How much will it cost to insure my teenage driver?

- Are parents liable for accidents their kids cause?

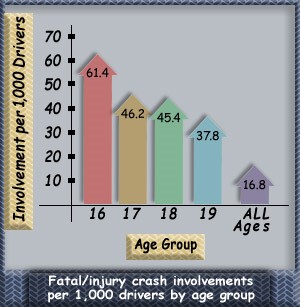

It is a rite of passage for all young Americans. Getting your driver’s license is perhaps the most exciting part of growing up. For parents it is a time of apprehension and anxiety about the safety of their children on today’s roadways. Along with the stress of having a new driver, there is a substantial cost involved. When you add a teenage driver to your policy, it raises your rates as most parents are well aware. Although it is expensive to add your teenage driver, there are factors that can help reduce the cost. Teenage drivers are the most expensive to insure because the fact remains that, statistically speaking, they are the most dangerous drivers on the road and have the highest rates of accidents as compared to with drivers with more experience.

https://www.cbsnews.com/pictures/deadliest-states-for-teen-drivers

https://www.cdc.gov/motorvehiclesafety/teen_drivers/teendrivers_factsheet.html

Most parents are apprehensive when adding their teenager to the policy. There are steps you should follow when adding a teen driver to your automobile insurance policy.

How to add a teenage driver onto your automobile insurance policy

There are several steps that you can take to make sure that your teenage driver has the appropriate coverage to protect them and yourself when they begin driving. As discussed below, it is important that you cover your teenager the same way that you cover yourself. In the state of Nevada, parents are liable for the negligence of their children if you signed for them to obtain a driver’s license.

1) The best time to begin the insurance process for your teenage driver is as soon as they get their learners permit. Your insurance company should be able to tell you what the cost will be to add them once they are licensed. Most insurance companies do not charge for the permitted drivers and therefore you have time to start shopping rates for your new driver.

2) Clients also often inquire as to whether they should get their teenage driver their own insurance policy rather than putting the teenage driver on the parents policy. I do not recommend for you to put your teenage driver on their own policy for several reasons. First, it is almost always more expensive to insure your teenage driver under their own policy than to put them on your existing policy. Secondly, and most importantly, your teenage driver needs coverage in the same amounts that you have because you are liable for their negligence if you signed for their learners permit or driver’s license which you did if they are under 18 years old. You cannot get a driver’s license in the state of Nevada without a parental signature if you are a minor under the age of 18. See statute below.

3) Although your automobile policy will generally automatically cover your teen driver without additional charge while they have a learners permit, you need to check with your insurance company to be certain. At that time, it is important to obtain a rate from your own insurance company as well as other insurance companies before adding your teenage driver.

4) I recommend my clients compare auto insurance rates from at least three major companies for the charge of adding a teenage driver. Although insurance companies provide the same coverages, their rates are vastly different and you could save a significant amount of money by going with a different carrier. As a general rule, I tell clients to only go with an insurance company they have seen commercials for or have agents in their area. You coverage is only as good as the company it is from.

5) Finally, there are discounts to mitigate the cost of adding a teenage driver. For example, teenagers who get good grades have lower rates as well as those who complete a defensive driving course or online driving school . Therefore, you want to make sure that your child has good grades, (for many reasons) but also to have reasonable auto insurance rates. If this is not the best way to get your child to get good grades, I am not sure what would be more incentive.

What kind of coverage should I get for my teenager?

Parents often make the mistake of trying to get the cheapest coverage possible for their teenage driver because of the large rate increase of adding a teenager. However, in the State of Nevada, parents are liable for the negligence of their children if they sign for them to get a driver’s license. Pursuant to NRS 483.300 a parent is liable for the negligence of a minor who obtains a driver’s license that the parents signed for the minor to obtain the license. It is very important to understand that when you’re adding your minor child to your insurance policy or a child that you have guardianship of, if your child is in an accident it is your assets that are at risk of a liability from the claim. I often recommend clients get an umbrella policy when adding a minor to the policy. You have to maintain certain liability limits to qualify for an umbrella and it generally has an additional out-of-pocket cost yearly. However, this is the best way to protect you and your family for an accident of a teenage driver.

Compare rates for different coverages when adding a teenage driver. When shopping for insurance coverage, it is helpful to have your specific vehicle in mind and do some research. If you have a VIN number on the car you can get an accurate rate if you have a make model and year or you can get a ballpark figure. Also, it is important to be truthful when you are shopping for rates when asked if there are any accidents or tickets in the past five years. Insurance companies will be able to locate those when they actually go to write your policy. And shockingly, although insurer’s providers are required to run a motor vehicle report before underwriting a policy, they often collect the first month’s coverage to bind coverage before running that report. If the report is different than the information you gave them that can result in a serious rate increase right off the bat.

How much will it cost to ensure my teenage driver?

Now for the big question, what’s it going to cost? Based upon our research, adding a 16-year-old male to your auto insurance policy will increase your premium by an average of 160% or approximately $2,250.00 according to our analysis. Adding a new female driver is a bit less expensive, generally raising rates about 125% for an extra $1750.00 rate increase. As the mother of three sons, this is not such good news. But ,again, your child’s grades and driver education courses will make a significant difference in your rates. Also, most insurance companies will give you a coupon code for your son or daughter to take an online driving class. As the parent of a teenage driver, I took this class with my son and I have to say I was quite impressed. The class is actually quite helpful as it basically simulates driving conditions your child will face and he or she needs to answer questions based upon the simulated driving exam. Below is a link to the class. The insurance companies will often offer you a coupon or a code to reduce the rate by half or more to take the class. I highly recommend that all teenage drivers take the class. https://www.teensmartdriving.com/insurance-partners/aaa/

Are Parents Liable for accidents of their teenage driving kids?

The answer is yes. Nevada law is clear on this issue. NRS 483.300 clearly states that when a parent or guardian signs for their minor child or ward to obtain a driver’s license, they are liable for damages for the accidents of their children. Since parents in Nevada are liable for the negligence of their children if they signed for them to obtain a driver’s license, it is important for them to have the same coverage you have for the rest of the family. NRS 483.300 states specifically as follows:

NRS 483.300 Signing and verification of application of minor by responsible person; liability.

- The application of any person under the age of 18 years for an instruction permit or driver’s license must be signed and verified, before a person authorized to administer oaths:

(a) By the applicant’s parent who has custody of the applicant or by either parent if both have custody of the applicant;

(b) If neither parent has custody of the applicant or if neither parent is living, by the person who has custody of the applicant, including an officer or employee of the State or a county if the minor is in the legal custody of the State or county;

(c) If neither parent has custody of the applicant or if neither is living and the applicant has no custodian, by the applicant’s employer; or

(d) If neither parent has custody of the applicant or if neither is living and the applicant has no custodian or employer, by any responsible person who is willing to assume the obligation imposed under NRS 483.010 to 483.630, inclusive, upon a person signing the application of a minor.

2. Except as otherwise provided in NRS 41.0325, any negligence or willful misconduct of a minor under the age of 18 years when driving a motor vehicle upon a highway is imputed to the person who has signed the application of the minor for a permit or license and that person is jointly and severally liable with the minor for any damages caused by such negligence or willful misconduct.

If you have a question about adding your teenage driver to your insurance policy or any type of accident involving a personal injury, whether from a car accident or a slip and fall or any combination of injuries, please don’t hesitate to call The Law Offices of Laura Payne Hunt, PC, and Henderson Injury Attorneys for over 13 years. Please call our office if you or if a loved one is injured. We can make sure that you receive the care you need and deserve and advise on how to preserve evidence. If you have been in any type of accident and have questions, please don’t hesitate to contact our Henderson and Las Vegas Accident injury offices today. At our office, we are experienced in helping injured victims get the compensation they are entitled to. Insurance companies never have the best interest of the injured person at the top of their priorities. They want to pay as little on every claim as possible. Having worked for an insurance company as an attorney for 9 years before opening my boutique law firm specializing in helping injured people, I reviewed thousands of auto accident claims and policy provisions.

At the Henderson and Las Vegas Accident injury Law Offices of Laura Payne Hunt, PC we are here to help you and your family in the event that accidents and tragedies occur. For any of your legal needs, do not hesitate to contact our Henderson and Las Vegas Accident injury Henderson offices. The Law Offices of Laura Payne Hunt is a boutique, family owned law firm in Henderson that specializes in helping injured people and the community with legal issues involving auto accidents, wrongful deaths, slip and falls, truck accidents, injuries to children, bicycle accidents, dog bites, and all types of injury claims. Please do not hesitate to call us anytime you have a legal question or you or a loved one has sustained an injury at 702-450-(HUNT) 4868 and text 24/7 at 702-600-0032.