HOSPITAL BILLING PRACTICES THEY MUST FOLLOW

Estimated Reading Time: 8.3minutes

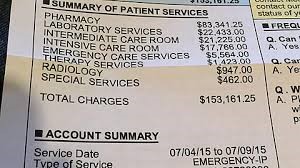

FIVE FACTS ABOUT HOSPITAL BILLING PRACTICES THEY MUST FOLLOW

- Hospitals Must Bill your Health Insurance Before They Can Bill you on a Hospital Bill;

- Interest on Past Due Medical Mills Cannot Exceed the Prime Interest Rate;

3) Hospitals Cannot Charge you Late Fees for the Unpaid Amount;

4) Unfortunately they Can Charge Collection or Attorney’s Fees if They Make Efforts to Recover;

5) Most Importantly Hospitals Cannot move to Collect Against your car Insurance or

Any Other Insurance or Monies that you have if They are Contracted with Your Health Insurer;

As a personal injury attorney in Henderson, Nevada in Las Vegas Nevada for over 20 years, I am still shocked at the tactics that hospitals use against patients. Never provide your car insurance information or any other insurance information or personal information (with the exception of name, address, date of birth, social security number) Only provide your health insurance information to a hospital. I have seen hospitals take clients medical payments coverage and still bill the insurance many times and it’s illegal but that does not mean anything to some hospitals. The Nevada Revised Statutes clearly prohibit this behavior. Even though this is an illegal practice in the state of Nevada, it happens. Unfortunately, It happens a lot because patients don’t know the law . I have seen hospitals immediately send a bill to a client’s medical payments coverage repeatedly.

As a quick review from past blogs, “medical payments coverage” is a coverage you can purchase with your car insurance. It is coverage that pays for your medical bills directly without co-pays or wait. It is a very helpful coverage to have and we urge all of our clients at TheOneLawyer.com to have this coverage on their policy. It is usually for a limited amount , generally anywhere from $1000 we’ve seen as high as $50,000, and it pays your medical bills or copays. Fortunately , it is generally a somewhat inexpensive coverage to add to your policy similar to rental coverage. We also urge our clients to have rental coverage. Medical payments coverage is important as it will cover all of your co-pays and if you are taken to an out of network facility it will cover bills related there too.

Sadly, we have seen unscrupulous hospitals immediately send a bill to client’s medical payments coverage carrier demanding the entire amount of the policy and the insurer will send the entire policy amount to the hospital. Coverage that is supposed to cover all of your co-pays and deductibles. In addition, the hospital turns around and bills the health insurance company and takes those funds as well. Don’t let this happen. That is why it is important to contact an experienced personal injury lawyer at TheOneLawyer.com and talk to attorney Laura Payne-Hunt , Esq. who will not let this happen to her clients. We immediately put the hospital and the insurance company on notice not to bill medical payments coverage. We also notify the auto medical payments coverage insurer that no funds are to be paid on our client’s behalf from the medical payments policy without the direct express authorization of our office.

If you are in an automobile accident it is important to contact counsel immediately to maximize the coverage that you have in place. At TheOneLawyer.com , we will make sure that you will receive the maximum award possible for your pain and suffering as well as your medical bills. The statutes outlined below show the rights and remedies that you have under Nevada law against the hospital that renders treatment. Watch for our future blog regarding recent legislation signed into law by governor Steve Sisolak further protecting Nevadans against unscrupulous hospital billing practices.

NRS 449.757 Limitations on efforts of hospitals to collect; date for accrual of interest; rate of interest; limitations on additional fees.

1. When a person receives hospital care, the hospital must not proceed with any efforts to collect on any amount owed to the hospital for the hospital care from the responsible party, other than for any copayment or deductible, if the responsible party has health insurance or may be eligible for Medicaid, the Children’s Health Insurance Program or any other public program which may pay all or part of the bill, until the hospital has submitted a bill to the health insurance company or public program and the health insurance company or public program has made a determination concerning payment of the claim.

2. Collection efforts may begin and interest may begin to accrue on any amount owed to the hospital for hospital care which remains unpaid by the responsible party not sooner than 30 days after the responsible party is sent a bill by mail stating the amount that he or she is responsible to pay which has been established after receiving a determination concerning payment of the claim by any insurer or public program and after applying any discounts. Interest must accrue at a rate which does not exceed the prime rate at the largest bank in Nevada as ascertained by the Commissioner of Financial Institutions on January 1 or July 1, as the case may be, immediately preceding the date on which the payment becomes due, plus 2 percent. The rate must be adjusted accordingly on each January 1 and July 1 thereafter until the payment is satisfied.

3. Except for the interest authorized pursuant to subsection 2 and any court costs and attorney’s fees awarded by a court, no other fees may be charged concerning the amount that remains unpaid, including, without limitation, collection fees, other attorney’s fees or any other fees or costs.

(Added to NRS by 2007, 1497; A 2011, 1525)

NRS 449.758 Limitations on efforts of hospital to collect when hospital has contractual agreement with third party that provides health coverage for care provided; exception.

1. Except as otherwise provided in subsection 2, if a hospital provides hospital care to a person who has a policy of health insurance issued by a third party that provides health coverage for care provided at that hospital and the hospital has a contractual agreement with the third party, the hospital shall proceed with any efforts to collect on any amount owed to the hospital for the hospital care in accordance with the provisions of NRS 449.757 and shall not collect or attempt to collect that amount from:

(a) Any proceeds or potential proceeds of a civil action brought by or on behalf of the patient, including, without limitation, any amount awarded for medical expenses; or

(b) An insurer other than a health insurer, including, without limitation, an insurer that provides coverage under a policy of casualty or property insurance.

2. This section does not apply to:

(a) Amounts owed to the hospital under the policy of health insurance that are not collectible; or

(b) Medicaid, the Children’s Health Insurance Program or any other public program which may pay all or part of the bill.

3. This section does not limit any rights of a patient to contest an attempt to collect an amount owed to a hospital, including, without limitation, contesting a lien obtained by a hospital.

4. As used in this section, “third party” has the meaning ascribed to it in NRS 439B.260.

(Added to NRS by 2011, 1524)

NRS 449.759 Manner of collection. A hospital, or any person acting on its behalf who seeks to collect a debt from a responsible party for any amount owed to the hospital for hospital care must collect the debt in a professional, fair and lawful manner. When collecting such a debt, the hospital or other person acting on its behalf must act in accordance with sections 803 to 812, inclusive, of the federal Fair Debt Collection Practices Act, as amended, 15 U.S.C. §§ 1692a to 1692j, inclusive, even if the hospital or person acting on its behalf is not otherwise subject to the provisions of that Act.

(Added to NRS by 2007, 1498)

At the Law Offices of Laura Payne-Hunt, TheOneLawyer, we provide professional and personal service to each and every one of our clients on various legal matters and have over 15 years of experience in reviewing insurance policies. If you have a question regarding any type of personal injury or paying your medical bills from an accident, please don’t hesitate to call the offices of TheOneLawyer.com and speak directly to attorney Laura Marie Payne-Hunt, Esq. a Henderson Injury Attorney for over 15 years. Laura is recognized as one of Nevada’s Top 100 Lawyers. She has the experience and knowledge to obtain the maximum settlement you deserve. Please call our office if you or a loved one is injured. We can make sure that you receive the care you need and deserve and advise on how to preserve evidence.

At our office, we are experienced in helping injured victims get the compensation they are entitled to. Insurance companies never have the best interest of the injured person at the top of their priorities. They want to pay as little on every claim as possible. Having worked for an insurance company as an attorney for 9 years before opening my boutique law firm specializing in helping injured people, I have reviewed thousands of auto accident claims and policy provisions.

At the Henderson and Las Vegas Accident injury law offices of TheOneLaweyer.com, Laura Marie Payne-Hunt and her staff are here to help you and your family in the event that accidents and tragedies occur. For any of your legal needs, do not hesitate to contact our Henderson and Las Vegas Accident injury offices. TheOneLawyer.com is a boutique, family owned law firm that specializes in helping injured people and the community of Las Vegas and Henderson Nevada with legal issues involving auto accidents, wrongful deaths, slip and falls, truck accidents, injuries to children, bicycle accidents, dog bites, product liability claims, and all types of injury claims. Please do not hesitate to call us anytime you have a legal question or you or a loved one has sustained an injury at 702-450-(HUNT) 4868 and text 24/7 at 702-600-0032.